It said revenues (EBIT) were €93m (€92m in Q1), below estimates of €93m-€96m, and that investor expectations were muted into the print, but with unchanged outlook, it expected 2023 consensus EBIT of €380m as broadly unchanged.

“Overall, we see 2023 consensus EBIT of €380m being broadly unchanged, but modest downside at EPS level, given previously announced one-off Prague planned plant closure costs are not tax-deductible. We expect a better 2H vs 1H EBIT performance, with modest improvement in volumes and benefit of lower cost inflation (i.e. boxboard, polymer, waste paper & logistics) but their packaging pricing ‘sticking’ for longer, supporting margins.

The bank’s analysts said after a call with Huhtamaki, it recorded support for a better second half of the year compared to the first half.

“Driven by modest improvement in vols (contribution from new projects & reducing destock headwinds), packaging price/mix stable into 3Q, productivity initiatives & benefit of lower cost inflation supports EBIT (i.e. boxboard, polymer, waste paper & logistics).”

It said flexible packaging remains challenging: “Flexible plastic packaging has a longer supply chain, and greater ability to store stock through the chain & thus is continuing to see destocking headwinds. India (c8% sales) is focused on premium brands, and is likely to continue to see trading down. Short-term profitability improvement will be driven by volumes whilst longer term, the flexible division is a self-help recovery story potentially boosting group EBIT by >10% vs 2023 lows.”

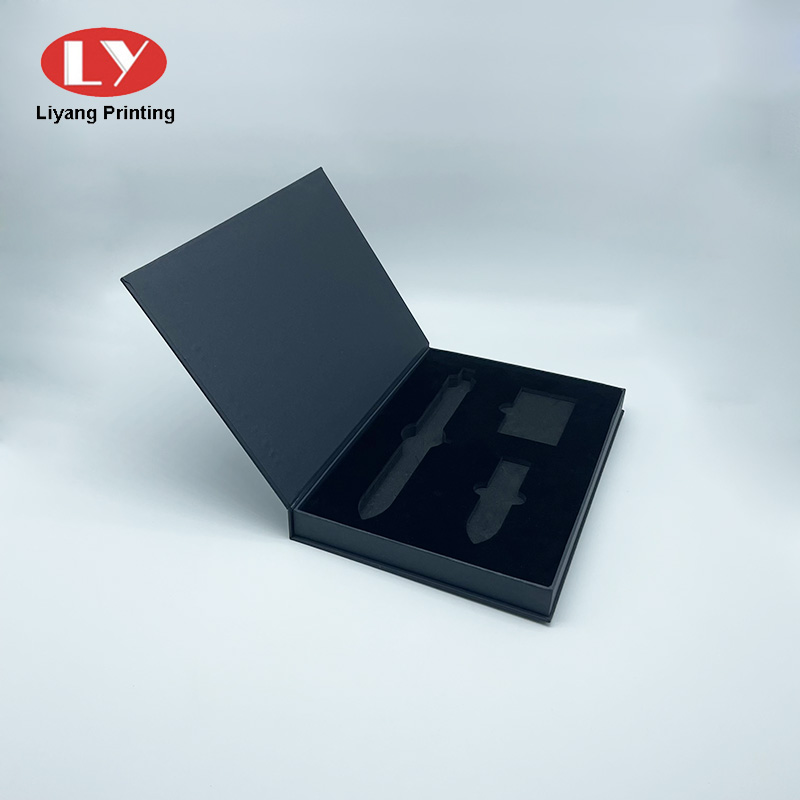

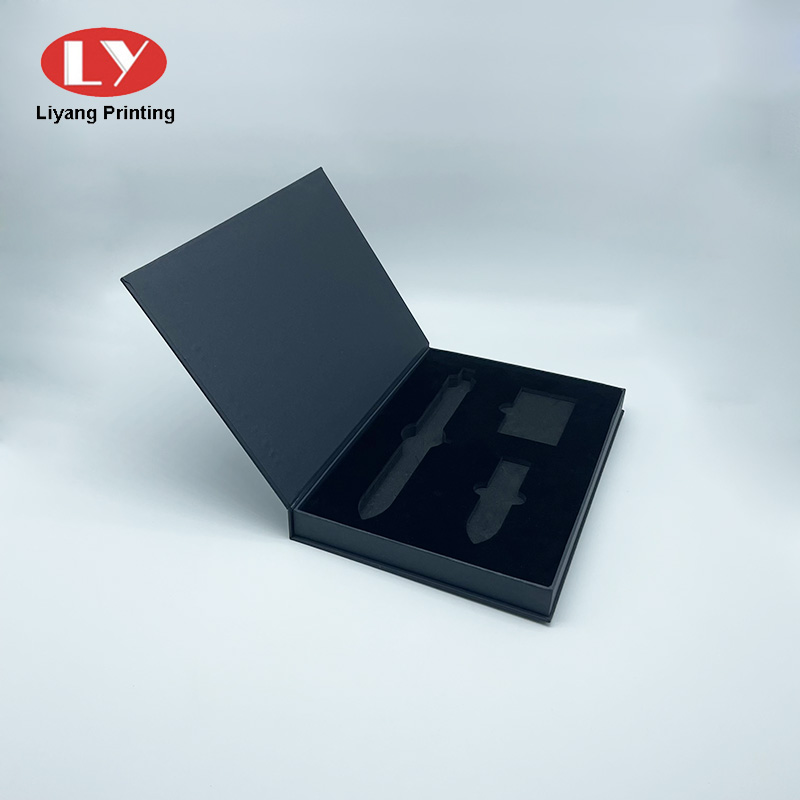

Liyang Paper products co., ltd is a factory and trade company located in Dongguan, China. Specialized in producing gift paper packaging and printing, such as gift box, gift bags, book printing, notebooks, folders, wine box,jewelry box, cosmetic box, watch box, shoe box,etc.Custom made base on your design is welcome, feel free to contact Liyang printing with your full detail.